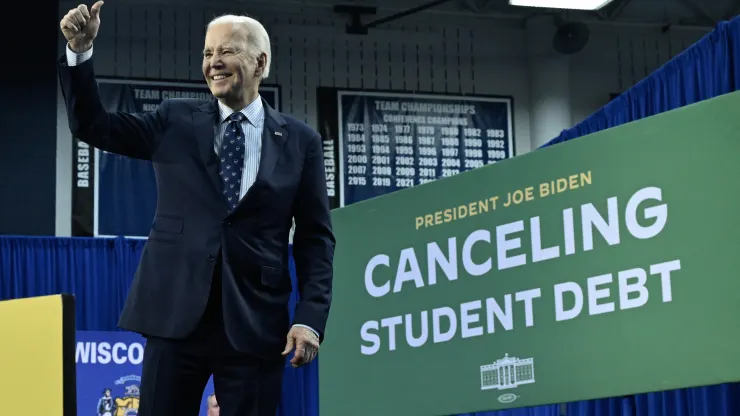

Biden student loan repayment plan to resume amid legal challenges, federal appeals court rules

In a Sunday ruling, the 10th Circuit U.S. Court of Appeals granted the Biden administration’s request to stay an order from last week that temporarily blocked a provision of its Saving on a Valuable Education, or SAVE, plan.

The decision is a major win for Biden, experts say. The SAVE plan was his biggest accomplishment to date in delivering relief to student loan borrowers. So far, around 8 million borrowers have signed up for the new income-driven repayment plan, according to the White House.

Last week, just as the Biden administration prepared to lower borrowers’ monthly payments under the SAVE plan, a federal judge in Kansas issued an injunction blocking it from doing so.

The Department of Justice quickly appealed.

The appeals court ruling will allow the Biden administration to go ahead with lowering borrowers’ monthly payments.

Under SAVE, many borrowers pay just 5% of their discretionary income toward their debt each month, and anyone making $32,800 or less has a $0 monthly payment. On the other income-driven repayment plans, borrowers pay 10% or more of their discretionary income.

SAVE student loan forgiveness still on hold

The second injunction against the SAVE plan, which came down last week from a federal judge in Missouri, remains in effect. As a result, the Biden administration remains unable to forgive people’s student debt under the plan.

The Justice Department is expected to appeal Missouri’s decision as well.

The preliminary injunctions from Kansas and Missouri were a result of lawsuits filed earlier this year by Republican-led states. The states argued that the Biden administration was overstepping its authority with the SAVE plan, and trying to find a roundabout way to forgive student debt after the Supreme Court struck down its sweeping plan last year.

By mid-April, 360,000 borrowers received $4.8 billion in debt relief under SAVE, the Education Department reported.

Full Article: https://www.cnbc.com/2024/07/01/biden-student-loan-plan-to-resume-amid-legal-challenge-appeals-court.html